Financial Needs Analysis: Charting Your Path to Financial Security

Your Financial Future, Tailored to You

Financial Plans (FNA)

If you're like many people, you're in the dark about your finances. You pay your bills each month and do your best to prepare for the future. But the truth is, there's only so much money to go around and preparing for the future can be overwhelming.

One of the most important building blocks in establishing a firm financial foundation is determining the difference between "wants" and "needs." Sounds simple, doesn't it? A "want" is something you don't require for basic survival and a "need" is something you must have to live. Yet, sometimes it can be hard to tell where a "want" begins and a "need" ends - especially where immediate family is concerned. Financial health is all about the choices you make over the long term.

Income Protection

Offers a variety of strategies to ensure your family's financial future should you die prematurely.

Retirement Protection

Retirement ProtectionProvides a detailed analysis of how much money you need to prepare for retirement.

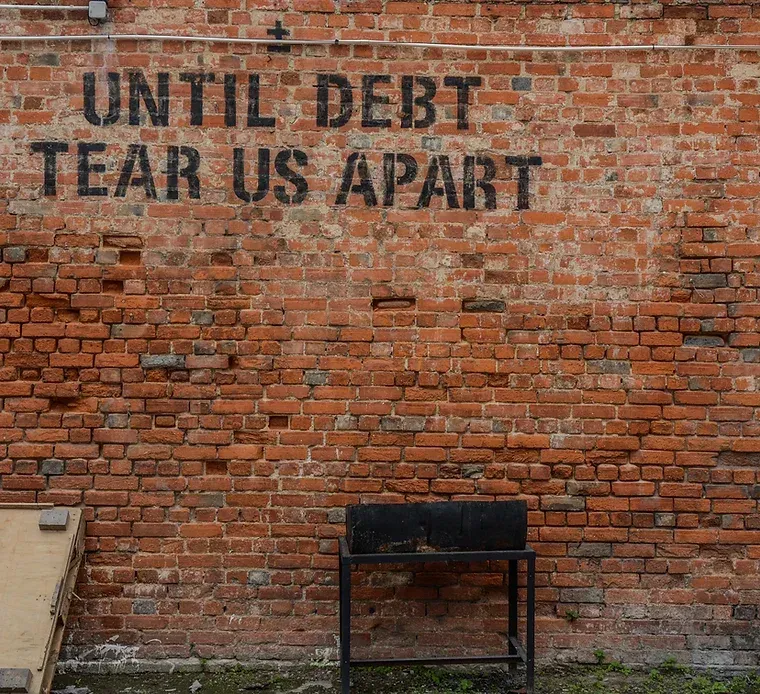

Debt Solutions

Illustrates strategies for paying off credit cards and loans in the quickest, most efficient manner possible with little or no additional cash outlay.

Education Funding

Projects actual costs for specific schools you select, then shows you several strategies for funding your children's education expenses.

Financial Independence

Pulls all your information together by outlining specific steps to put your plan into action.

FAQS

What is the benefit of working with a financial advisor?

Working with a financial advisor offers numerous benefits. First and foremost, advisors provide expertise and guidance tailored to your unique financial situation and goals. They can help you create a comprehensive financial plan, optimize your investments, minimize taxes, and ensure you're on track to achieve your financial objectives. Additionally, advisors offer peace of mind, knowing that you have a professional managing your financial affairs and helping you make informed decisions.

How do I choose the right financial advisor for my needs?

Choosing the right financial advisor is a critical decision. Start by assessing your own financial goals and preferences. Look for advisors with the appropriate qualifications and certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Consider their experience, specialization, and track record. It's also important to have a consultation or interview to ensure their approach aligns with your values and objectives. Lastly, check for transparency in fees and compensation to avoid surprises.

Do I need to have a lot of money to benefit from financial advisor services?

No, you don't need to be wealthy to benefit from financial advisor services. Financial advisors can assist individuals at various stages of their financial journey, from those just starting to save to those with substantial assets. Advisors can help you create a financial plan, manage debt, set up an emergency fund, and make the most of your resources, regardless of your current wealth. Their goal is to help you improve your financial well-being and work towards your financial goals, whatever they may be.